All Categories

Featured

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

[/image][=video]

[/video]

Withdrawals from the cash money value of an IUL are normally tax-free approximately the amount of costs paid. Any withdrawals over this amount might be subject to tax obligations depending on plan structure. Traditional 401(k) payments are made with pre-tax bucks, decreasing taxable income in the year of the payment. Roth 401(k) payments (a strategy attribute readily available in many 401(k) strategies) are made with after-tax payments and afterwards can be accessed (incomes and all) tax-free in retirement.

Withdrawals from a Roth 401(k) are tax-free if the account has actually been open for a minimum of 5 years and the individual mores than 59. Assets taken out from a typical or Roth 401(k) before age 59 may incur a 10% fine. Not specifically The insurance claims that IULs can be your own bank are an oversimplification and can be misinforming for several factors.

However, you might go through upgrading linked health and wellness concerns that can impact your continuous costs. With a 401(k), the money is constantly your own, including vested company matching despite whether you give up contributing. Danger and Guarantees: Most importantly, IUL policies, and the money value, are not FDIC insured like basic bank accounts.

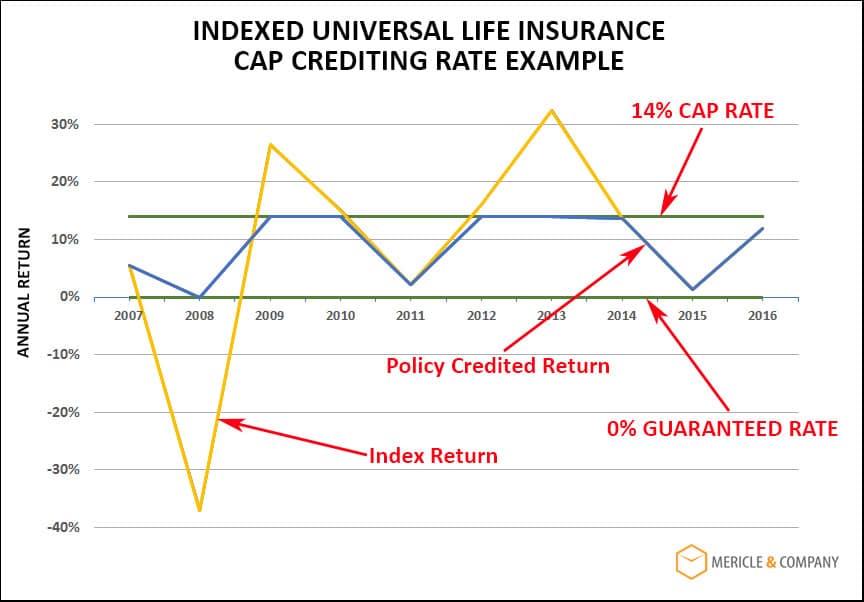

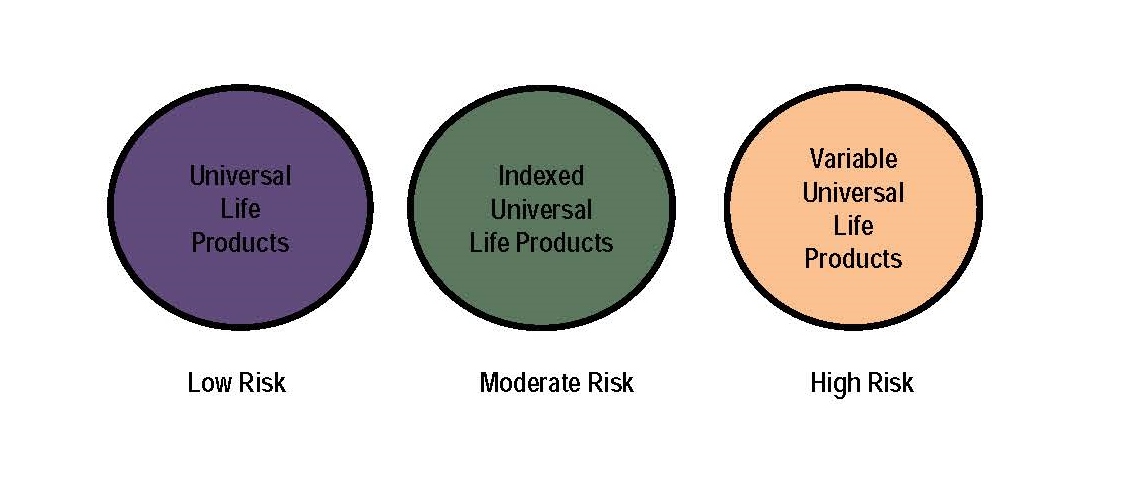

While there is commonly a floor to prevent losses, the growth capacity is topped (indicating you might not completely benefit from market increases). A lot of experts will agree that these are not equivalent products. If you want survivor benefit for your survivor and are concerned your retirement financial savings will not be sufficient, then you might intend to think about an IUL or other life insurance item.

Certain, the IUL can give access to a cash account, but once again this is not the key purpose of the product. Whether you want or need an IUL is an extremely individual concern and depends on your main financial purpose and objectives. Listed below we will attempt to cover benefits and constraints for an IUL and a 401(k), so you can even more define these items and make an extra informed choice regarding the ideal way to handle retirement and taking treatment of your loved ones after fatality.

Iul Retirement Calculator

Car Loan Prices: Finances versus the plan accumulate passion and, otherwise settled, reduce the fatality benefit that is paid to the beneficiary. Market Participation Limits: For most plans, investment development is tied to a supply market index, but gains are typically topped, limiting upside potential - iul retirement calculator. Sales Practices: These policies are usually marketed by insurance agents who may emphasize benefits without fully clarifying prices and threats

While some social media sites experts recommend an IUL is a replacement item for a 401(k), it is not. These are different items with various purposes, features, and prices. Indexed Universal Life (IUL) is a kind of long-term life insurance coverage plan that likewise provides a money value component. The cash money worth can be used for several functions consisting of retirement financial savings, additional revenue, and other financial demands.

Latest Posts

Fixed Index Universal Life Insurance

Iul Life Insurance Explained

Nationwide Iul Accumulator Quick Quote